When Should You Get Additional Insurance For Your Jewelry

If you have jewelry valued above your homeowners insurance personal property limits, you need to consider a floater add-on policy or separate standalone personal jewelry insurance. Additionally, if you have custom jewelry or heirloom pieces, like an engagement ring, watch, or necklace, you should get a separate policy.

Both a floater and personal jewelry insurance require an appraisal for the items to be insured. Normally, your jeweler will refer you to an appraisal company. If you do not have an appraisal, receipts for the items are acceptable.

Do I Really Need Jewelry Insurance

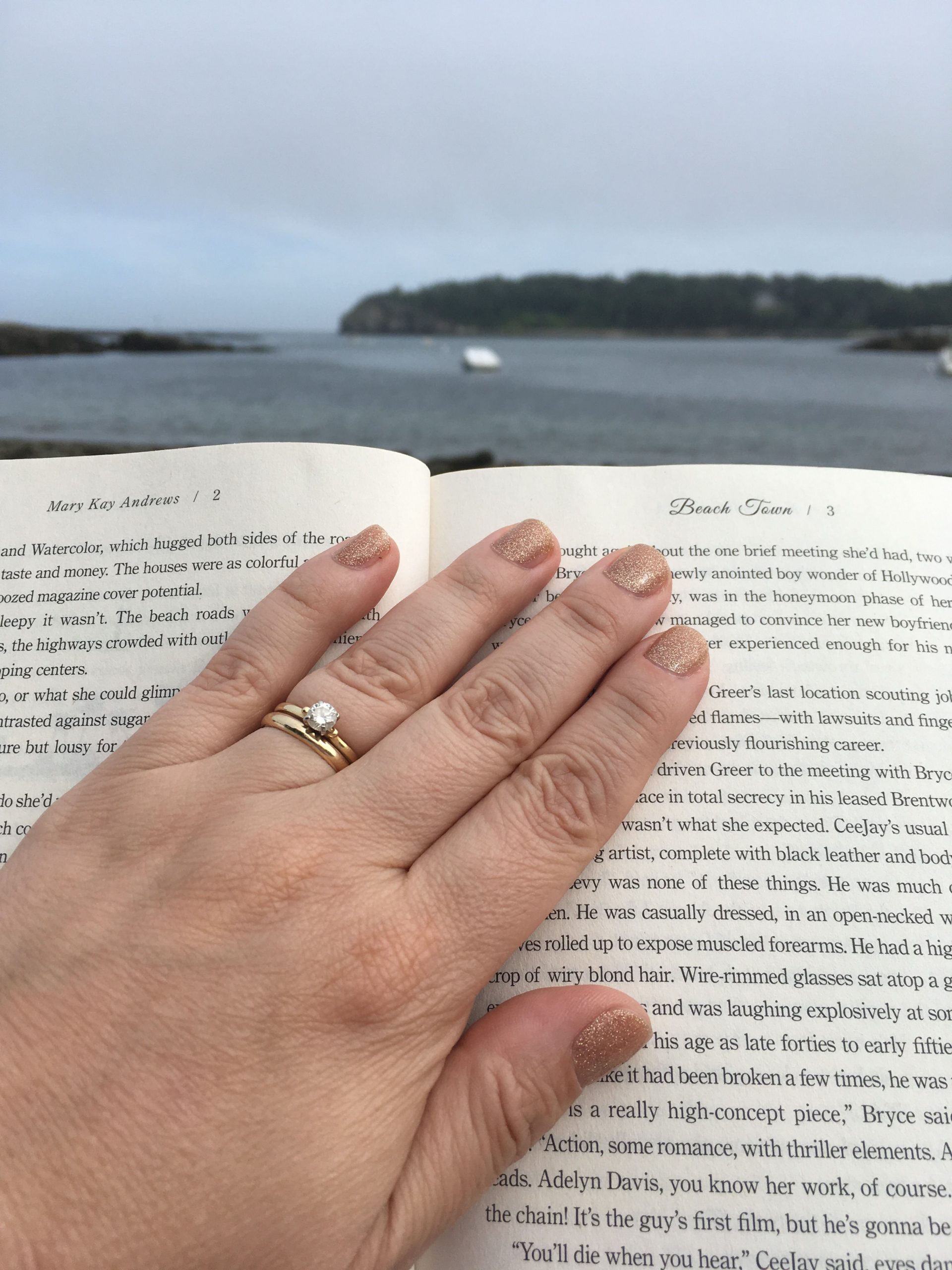

If you have a valuable or sentimental piece of jewelry, like an engagement ring, it is worth looking into jewelry insurance. Its easy for jewelry to go missing we often take off our rings to wash our hands, put on lotion, or go swimming. Some people end up wearing their engagement rings as little as possible out of fear of something happening to it. This shouldnt be the case jewelry is meant to be worn and enjoyed, especially a beautiful ring that your partner bought for you.

Even though every Ritani engagement ring automatically comes with a Ritani Lifetime Care Package, you should still consider insurance. The Ritani Lifetime Care Package includes a warranty for your ring, but this only includes repairs. It does not cover loss or theft. Luckily, getting jewelry insurance and filing a claim is usually very easy online.

What Is Covered Under Jewelry Insurance

A good insurance plan will cover the full value of your jewelry in the event of damage, theft, accidental loss, and mysterious disappearance. A jewelry insurance policy that promises to cover the full cost of your jewelry will almost always include sales taxes as a part of your coverage.29 avr. 2020

Also Check: Wedding For Under 5000

Get Engagement Ring Insurance Asap

Your soon-to-be fiancé can insure the ring as soon as it’s purchased and in their possessionmuch like you would insure a car prior to driving it off the lot. You might not initially be thinking of anything happening to your precious and sentimental token, but the sooner it’s insured, the sooner you’ll be protected. Once purchased, you or your partner can begin to shop for ring insurance providers. Krowiorz notes that the timeline can vary depending on the individual case. Coverage can be provided right away or may take an estimated two to four business days if subject to underwriting review.

How Does Jewelry Insurance Work

If your jewelry is lost, stolen or significantly damaged, file a claim to get started. Remember to first consider what works best for you. If you have valuable jewelry and dont think youll be able to cover it all yourself in the event of a loss, talk to your agent about adding itemized personal property coverage.

Don’t Miss: How To Make A Wedding Bouquet With Fake Flowers

What Is The Jewelry Insurance Claim Process Like

Insurance claims for jewelry go through a very similar process to car insurance claims. A policy agent will assign you a claim number and you will be asked to provide any relevant photos, police reports, and documentation about your stolen jewelry.

Two documents that will be essential to filing a jewelry insurance claim are a value appraisal for the stolen piece and, if it is a piece of diamond jewelry, the center diamonds GIA or AGSL certification report. If you purchased your ring from a reputable jeweler, theres no need to worry if you lost your appraisal or diamond grading report. You should be able to request another appraisal and the grading laboratories should have no problem sending you a replacement report.

Myth : If I Lose My Engagement Ring Im Covered Under My Homeowners Or Renters Insurance Policy

Errrrr We hate to break it to you, but that is not true. In addition to only getting a portion of your engagement rings value covered if its stolen, homeowners/renters insurance policies typically do not cover your ring if you lose it. So if youre doing dishes, take your engagement ring off and it slips down the drain, and you cant retrieve it, guess what? Your insurance policy isnt going to cover the cost of replacing ityou will have to shell out the money to replace your diamond engagement ring.

You May Like: Wedding Under 5k

Does Homeowners Insurance Cover Jewelry

I feel sick. I lost my ring in the lake while boating. But my homeowners insurance covers jewelry, so I’ll just give them a call.”

“Wait, what? My policy doesnt cover accidental jewelry loss?

Finding out your homeowners or renters insurance falls short after youve already lost your ring leaves you wondering what to do next. Do you pay for a replacement out of your own pocket? Or go without a ring?

Rock. Hard place.

So how do you know which insurance option won’t leave you empty-handed when the unexpected happens? Read on to understand what situations are covered under homeowners insurance and specialized jewelry insurance and for how much.

So What Should I Do About Insuring My Engagement Ring

You should, by all means, insure your home or apartment with homeowners or renters insurance policies just dont fall into the trap of solely relying on them to cover your precious diamond engagement ring or other treasured pieces of jewelry. After all, an engagement ring is more than just a pretty, shiny thing that sits on the finger of your beloved: its a memory, a promise, and a legacy!

At Zillion, we specialize in stand-alone jewelry insurance policies for your engagement ring, so you can wear it with confidence. Protecting your diamond jewelry ensures it will stay beautiful and valuable for years to come.

Here are just a few of the benefits of purchasing an insurance policy for your diamond ring:

Also Check: Etiquette For Addressing Wedding Invitations Without Inner Envelope

What’s The Cost Of Insuring Jewelry

Insuring jewelry may vary in price among insurance companies and often means an additional cost if you need to schedule certain pieces. For instance, a $5,000 engagement ring may cost about $50-$100/year to insure. If you’re looking for an exact price, contact your insurer for additional information.

Does Renters And Homeowners Insurance Cover Lost Jewelry

If you lose a piece of jewelry, you may be covered in most cases. With floaters and endorsements, there are often lower or no deductibles, and frequently you will have the option of having the insurance company replace the item for you.

While your homeowners insurance policy may cover jewelry theft, the best protection is avoiding an incident in the first place. Here are some tips to help keep your jewelry safe from theft.

You May Like: Where To Buy Randy Fenoli Wedding Dresses

How To Get Extra Insurance Coverage For Your Jewelry

You can ask your homeowners insurance to increase your personal property limit, but “the amounts are still limited for both individual pieces and overall losses,” according to the Insurance Information Institute.

A second option is purchasing a floater policy as an add-on to your homeowners insurance. The Insurance Information Institute notes that although this is more expensive, it offers the broadest coverage, including coverage your standard homeowner’s policy doesn’t include. Your jewelry must be appraised before purchasing a floater.

Another option is to purchase personal jewelry insurance. Bryan Howard, director of product management for Jewelers Mutual, told Business Insider that unlike a homeowners policy, “a standalone jewelry policy is a comprehensive, all perils policy, meaning it covers every type of loss unless specifically excluded.”

With standalone jewelry insurance, your jewelry must be appraised. Howard noted that the premium for personal jewelry insurance is typically 1-2% of the item value. The premium will also be based on where you live, who’s wearing the jewelry, and the deductible.

Here’s a comparison of the jewelry coverage you can get with homeowners insurance, a floater policy for homeowners insurance, and a standalone jewelry insurance policy such as Jewelers Mutual.

| Coverage features |

Data from Jewelers Mutual

Filing A Jewelry Insurance Claim Is So Much Easier

When filing a claim on an engagement ring through a homeowners/renters insurance policy, youre stuck dealing with whatever company or jeweler your insurance company is contracted with. But when you purchase a specialized, stand-alone jewelry insurance policy like the ones we offer at Zillion, the claims process is faster and more efficient thanks to the fact that we work directly with your trusted jeweler to settle the claim on your engagement ring.

You May Like: How Much Do Wedding Coordinators Make

Why Is Specialized Jewelry Insurance Best For Insuring Your Jewelry

Your Diamond Ring Is Covered But Maybe Not The Full Cost

The good news is that items of value that are lost or damaged are typically covered under your home insurance policy. After paying your deductible, your home insurance will likely cover the replacement of the ring but only up to your single item limit. This is usually between $1000 and $2500. That means if your ring was worth more, youll only receive this amount.

The exception is if you insured it with a specialized endorsement known as a floater. This protection is designed for more expensive items like jewellery, artwork, sports equipment and collections to ensure theyre adequately insured.

The key is to make sure you have enough coverage for your most valuable items. That means talking to your independent insurance broker before you have to make a claim about getting extra coverage added to your homeowner policy. This may mean a slight increase in your monthly or annual premiums but it ensures that youre fully covered for the total loss should something happen to your precious jewellery.

The cost for adding extra insurance coverage for your jewellery is quite nominal typically 1.5% to 2% of the rings appraised value. That means on a $5,000 engagement ring youd pay an extra $75 to $100 per year for this extra protection. However, prices will vary depending on the insurer and what youre insuring.

Talk to your broker for more information about insuring your jewelery.

Don’t Miss: How To Make A Wedding Spreadsheet

Does Homeowners Insurance Cover Lost Jewelry Like Wedding Ring

No, the standard homeowners insurance will not mostly coverjewelry, particularly expensive jewelry.

On paper, the homeowners insurance has a certain provisionfor personal property coverage and will provide coverage for your wedding ring.However, when it comes to claiming for the loss of such an expensive item, thiscoverage is not substantial and may not be able to cover the entire cost of thewedding ring.

Generally, your standard homeowners insurance will providecoverage for personal property up to the amounts of $1,000 or $2,000 per itemsubject to a maximum limit for all items. Aside from this limited amount, thedeductible will also kick in, further decreasing the amount you stand to getfrom the insurance company. Also, the claim is paid based on the appraisedvalue of the ring and may be subject to depreciation or wear and tear.

For instance, you have a policy that provides $1,000 peritem as part of your personal possessions coverage, with a $500 deductible.Your wedding ring is worth $10,000 and it was stolen. The insurance companywill pay only up to $1,000. That means you will only get $500 from yourinsurance company for a $10,000 ring.

You need to get a jewelryfloater that outlines and covers the specific pieces of jewelry that youhave and want to protect. This is for all your expensive personal property suchas jewelry, furs and musical instruments, that exceed the limits of your policyfor personal possession coverage.

| Not a bit |

How Should I Keep My Jewelry Safe

You should consider investing in a safe to store your jewelry in when youre not wearing it. Doing so can keep the costs of your insurance down. You should take photos of the process and describe where it is in your house so you can show your insurance you are not being careless with your valuables.

The first place a burglar looks is usually the bedroom because it is where most people store their valuables. If youre very concerned about your jewelry being stolen, you may want to consider a sneakier place to store your safe.

You May Like: Randy Fenoli Partner Michael Landry

Myth : My Engagement Ring Is Fully Insured

Myth, busted! Now, its true that you can cover your jewelry under renters or homeowners insurance policies, like State Farm or Allstate to a point. Typically, these types of insurance policies are limiting, and can in some loss scenarios only cover a part of the rings value, or not at all. For example, if something happens to your diamond engagement ring, and it is included in your renters insurance policy, youll get some protectionbut probably not enough to fully cover the cost of replacing your ring if its stolen. And you will most likely have no protection if your ring simply went missing.

If your home is broken into, and your engagement ring is stolen, your renters insurance policy will cover it again, to a point. Even if your diamond jewelry is included in your renters insurance policy, you will not get reimbursed the full value of that ring, leaving you potentially thousands of dollars out of pocket to replace your jewelry. The monetary limit on jewelry thats covered under a renters insurance policy is typically only $1,500a fraction of what most people pay for their diamond engagement rings.

Renters insurance typically only covers your engagement rings and other items in the event of certain listed perils. If tragedy befalls your ring and its not listed as one of these perils, then too bad, so sadyour insurance policy will not cover the cost of your ring not even a portion of it.

What Exactly Does Jewelry Insurance Cover

Insurance companies will give you different options to insure your jewelry. A good insurance plan will cover the full value of your jewelry in the event of damage, theft, accidental loss, and mysterious disappearance. A jewelry insurance policy that promises to cover the full cost of your jewelry will almost always include sales taxes as a part of your coverage.

Insurance terms can get a little confusing, so lets dissect them.

Read Also: What To Put In Wedding Guest Gift Bags