Add Your Bank Details And Receive Your Funds

The final step to creating your registry is to verify your account with Stripe, the world leading credit card payment processor. When you launch, your registry provides will do all the heavy lifting for you – simply leaving you to provide Stripe with some quick details, such as your bank account information and postal address.

Once you launch your registry, you’ll receive an email directly from Stripe detailing exactly what you need to do. It’s a very smooth process and once you’re done, your honeymoon registry will be using the same secure technology used by many big brands around the world.

Once you start receiving contributions from guests, you’ll receive regular payments to your bank account directly from Stripe. Your first payment is made within 7 days, and all subsequent payments will be transferred from stripe to your bank account every 2 business days.

Ask Your Parents And Wedding Party To Spread The Word

Make sure to let your parents and bridal party know that you’d prefer cash and encourage them to tactfully spread the word. Chances are guests will ask them what they should get you, and this will prepare them to share what youâre saving for, whether itâs the trip of a lifetime, a kitchen remodel, or a down payment on a home you can call your own. They can then suggest that your guests make a contribution to your savings fund instead of getting you a new toaster.

How To Save For A Wedding Quickly

If youre planning to get married soon after getting engaged, you could look at adjusting your monthly expenses and see where you can save by reducing your expenditure. Opening a competitive variable rate notice account may also help increase your savings in the short term.

Of course, lowering your overall wedding spend will also mean you reach your savings goal that much faster. The good news is there are plenty of ways you can reduce costs if youre planning a wedding on a tight budget. Read on to find out more.

Also Check: Google Wedding Spreadsheets

Get The Timing Right And Look For Wedding Deals

The time of year that you set for your wedding can also affect your budget and should be taken into consideration, says Winkfield. In general, wedding season extends from late spring and continues through early fall , so holding off until mid-winter might be less expensive, as vendors may drop their prices due to reduced demand.

With destination weddings, consider planning your trip for the off-season or shoulder season, when travel fares for flights and hotels typically fall. Once you have nailed down the timing, try to plan your wedding spending around seasonal sales as much as possible.

You may find deals on wedding rings in March or late summer, for example, while January is considered one of the best months to buy a wedding dress on sale. Just remember: If you are buying any wedding-related items on sale, make sure you are familiar with the store’s return policy. Saving 20%, 30%, or more is great, but if you need to replace that item with something else, you may be out of luck if the retailer doesnt allow refunds on sale items.

How To Set Up A Paypal Account To Receive Donations

wikiHow is a wiki, similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time. This article has been viewed 131,030 times.Learn more…

PayPal is an online payment system that allows you to receive donations and other payments through websites and email accounts. There are special considerations for non-profit organizations, although anyone can sign up for a PayPal account and get the code for a “Donation” button to insert on a web page. Set up a PayPal account and receive donations for your charitable venture or donation-financed project.

You May Like: How To Address Family On Wedding Invitation

Be Specific About How You’ll Use The Cash

Cash or a check can feel impersonal, so letting guests know where the money will go helps your guests feel more connected to the two of you and your plans. If you’re in the middle of a big project, like renovating your home or moving across the country, let guests know about it on your wedding website. Adding a more personal touch with the story of how the project got started, how far along you are, and even the pitfalls you’ve faced along the way will both make your guests feel more connected to your lives and also serve as a plea for help that they’ll be more inclined to answer.

Does The Couple Get 100% Of The Cash

If the couple choose a Prezola gift list then yes. With Prezola, theres no ties and no third parties so 100% of the money your guests give goes straight into the couples bank account, unlike most department stores. We do ask for a one-off fee of £59 to cover transfer costs, but this will upgrade you to a Premier Plus account meaning you can add cash contributions, honeymoon gifts and custom items from other websites to your gift list.

Read Also: Wedding Planning Excel Sheet

Wedding Savings Accounts: How I Saved For My Wedding

New here? You may want updates via email or RSS feed. Thanks for visiting!

When my husband proposed to me on July 10th, 2005, I was ecstatic. In fact, I’m pretty sure I screeched Yeeeeeeeeessssssssssssssssssssssssss before he could even pull the ring out of his pocket.

Our plan was to move into the little apartment above his work it was part of his compensation package then get married the following summer. Unfortunately , a few of the older ladies in the company didn’t like the idea of an unmarried couple living together, and they ended up changing the terms so we couldn’t both live there until we were married.

I was crushed until, of course, my mom suggested something novel. Get married this winter, she said. Why not?

Why not, indeed. I couldn’t think of any reason why we couldn’t get married six months from our engagement except for one: money.

The Fictional Wedding Calculator

We look at the costs of weddings from TV and film, and see how long the characters would need to save up to afford their big days.

Theyre the moments that made us smile, sigh, or even brought tears to our eyes. Weddings on TV and film show the happiest moments for some of our favourite characters, and are often what the whole plot has been leading up to. They can take hours, months or even years to happen, and if weve been following the romance from the start, it almost feels like were one of the guests.

Of course, weddings in real-life can take months or years of planning and saving, which is why thinking ahead and setting up a savings account specifically for your big day is a great idea. Whether you opt for a high interest fixed rate bond or a flexible easy access account, you stand a better chance of affording your dream wedding.

But back to the small and silver screen just how much do these fantasy weddings cost, and could the bride and groom really afford them on their wages? We put all the soppy, romantic stuff to one side and got to the heart of the issue.

You May Like: Wedding Planning Spreadsheet Template

Work Out A Rough Total Amount

The main benefit of using a honeymoon fund is that you only need to have a rough idea of the costs involved. This means you can set up your registry before, during, or after you have actually booked your honeymoon.

Pro Tip: For larger gifts, such as flights, or accommodation, most honeymoon fund websites allow your guests to contribute towards chunks of a gift. This way, guests won’t feel put off by the large price tag associated with these types of gifts.

It’s generally a good idea to create a variety of gifts that have a wide range of prices. We find guests usually prefer to contribute towards a whole gift , despite having the ability to contribute to parts of smaller gifts. We’ve found that larger gifts usually receive contributions the day before, or the day of, the wedding, while smaller gifts keep your registry ticking over before the others are fully funded.

Crunch The Numbers How Much Can You Afford

Take a look at your finances as they are now, and what theyre likely to be by the time you reach the day. Questions to ask include:

-

How much do you both have saved up now?

-

How much are you likely to be able to save until the wedding date?

-

What about any extra money that you might get, such as a tax return or bonus?

-

Are your parents or family likely to help out?

Read Also: Wedding Excel Spreadsheet

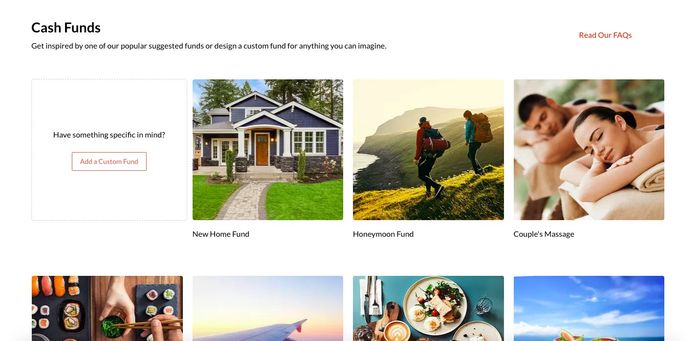

Better Than The Competitors

- Most trusted honeymoon registry and cash fund for 12+ years

- Immediate access to funds contributed

- Zero-fee payments options

- No fees to givers, ever

- The only gift card wedding registry

- Wedding web page, wedding fund and registry all in one

- Fully customizable wishlist to fund wedding, honeymoon, home, charity and more

- Register for anything on the web

- Store registry syncing

Saving For Your Wedding

Current accounts, savings accounts and ISAs

Just where should you keep your wedding fund? A savings account could be a sensible option and there are lots of different types available depending on your needs. Remember that some current accounts can offer better interest rates than dedicated savings options, although terms and conditions may apply.

If your wedding date is relatively close, you may want to consider an easy-access savings account. This should allow you to withdraw funds whenever you want, easily and without any penalties. As with a current account, though, you’ll have to be disciplined and remember that those lovely funds are there for your wedding – so hands off!

Have you got a year or more before your wedding? For the potential of a better interest rate, consider a savings account where you’re required to give notice when you need to make a withdrawal, the period of which will depend on the product.

A regular savings account, where it’s necessary for you to save on a monthly basis for a set period of time, could be the option you feel suits your needs. This will usually involve depositing a minimum amount every month, so make sure you’ve identified this and are able to commit.

Debt-surfing is a dangerous way of managing your finances

All such savings accounts will also be available within the tax-free wrapper of an ISA. These have defined annual limits – you can get the details from our guides.

Save on your bills

Recommended Reading: Wedding Spreadsheet

Is There A Right Amount Of Money To Spend On A Gift

“Ignore what your friends are doing and do what fits your budget and meets your lifestyle needs,” Post says. Nothing in etiquette dictates you have to give a gift at the same level of your friends.”

Eighteen percent of millennials report spending more than $500 in the last year on wedding gifts, which is double the number of Baby Boomers who also reported spending $500 or more, according to a recent survey from the virtual payment app Zelle. Of course, younger people generally attend more weddings than older ones, but $500 has always been and still is a hefty chunk of change.

Etiquette expert Elaine Swann, founder and C.E.O of the Swann School of Protocol, agrees with Post. “Were so far into this gift culture. Take yourself off the hook.” Swann says as a general guideline for gifts, it’s ok to start around $50 for distant relatives or co-workers and increase the amount from there based on how close you are to the bride and groom. Post says there’s no magic number at all.

“If you have seven weddings in one year, your gifts may be in the $15 range per wedding,” she says.

The bottom line? Find a number that feels comfortable for you, and don’t feel guilty if you can’t splurge on a lavish gift. It’s trite, but true: “Your presence is the present,” Swann says.

Create Honeymoon Gifts And Experiences

When creating gifts and experiences, look to create a set of honeymoon gifts and activities varied in a range of prices. Guests will always prefer to contribute towards items where they can buy the whole gift themselves , so it’s key to make sure there are plenty of gifts to choose from. As a guide, try to think of the rough amount you usually tend to contribute at weddings you’ve attended as a guest. A general rule that’s common with guests is to estimate what the couple might have spent per head, and contribute that amount.

Once you have a range of smaller gifts, it’s easier to fall back to create essential items, such as Airbnb’s, flights, and other travel related gifts.

See our examples of the type of detail we recommend to create an engaging and successful registry:

Want more tips on how to make your guests love your honeymoon fund website? Check out our 6 ways to make guests fall in love with your registry.

Don’t Miss: How To Address A Family On A Wedding Invitation

Ask To Be Informed Of Cancellations

Weddings are cancelled for all different kinds of reasons, which can be good news for you if youd like to score your dream venue at a discounted price. Just keep in mind that this will often mean little notice, and that could have a knock-on effect on your guestlist and other things that you need to have ready for the big day.

Set A Recommended Contribution Amount

Many guests who decide to contribute towards your honeymoon fund are looking for as much guidance as possible. Hitchd allows couples to set a recommended contribution amount, while still ensuring guests remain in control of how much they can contribute.

The recommended amount is set to $100 for your selected currency by default, however, this amount can easily be changed with one push of a button.

What is special here is that this is tastefully done, your guests are not aware that it is a pre-configured amount but have some soft guidance on how much they should provide only if they are not sure.

Read Also: Wedding Budget Spreadsheet Google Sheets

Break Down The Budget Into Target Savings Goals

Once you have arrived at an overall budget number, the next step is figuring out how much you need to save monthly or weekly to reach your target. A good formula to determine the budget is as follows: Number of months until wedding x realistic savings each month + contributions and existing savings = total wedding budget, Devlin says.

As you look at the overall budget number, consider how long you have to save for the wedding and think about whether you may get any financial help from friends or family members in planning it. If you have an overall budget of $30,000 and 10 months until you plan to get married, for example, youd need to save $3,000 a month to hit your goal, assuming you have not put aside anything for your wedding yet. However, if your parents are chipping in $10,000 as a pre-wedding gift, that drops the amount you need to $2,000 a month.

When running the numbers on monthly or weekly savings contributions, ask yourself if its realistic. If you cannot hit that savings number together continuously, then you have two options: Downsize the wedding to reduce the costs or consider delaying the wedding to give yourselves a longer window to stash away savings. The second option may not be ideal, but it could be the better choice if you dont want to take anything away from your overall wedding vision.