Alternatives To Wedding Insurance

Whether wedding insurance is a good investment depends on your situation. If you’re planning a large wedding with multiple vendors and a lot of guests, going without it could leave you liable if property is damaged, someone is injured or other issues arise. The peace of mind that comes with liability insurance may be worth it to you.

One alternative is to touch base with your vendors to see if they already have insurance of their own. If they do, ask if you can review their policies. You may feel comfortable saying no to wedding insurance if coverage is sufficient through your venue and other vendors. If they don’t have insurance, or their coverage seems thin, you might consider getting a policy of your own.

It’s also wise to carefully review all vendor contracts before signing. What are the repercussions if you have to postpone or cancel your event? If you’ll face a hefty financial burden, wedding insurance can help mitigate that risk.

Event Insurance For Your Wedding Charity Run & More

Whether you’re planning your big day or hosting a charity 5k run, Event Helper will make sure you can enjoy your event without worry. With Progressive® Wedding and Event Insurance by The Event Helper, Inc., you’re protected in case accidents happen so you can breathe easier and simply have fun. Plus, you can purchase cancellation coverage for your wedding, safeguarding your investment if you have to postpone or cancel.

Quote multi-day or one-day event insurance today and get your slice of peace of mind.

Do I Need To Get Event Insurance For Weddings

Aside from protecting yourself and giving you peace of mind, one of the main reasons youll likely need to purchase special event insurance for your wedding, reception, buck & doe, or bridal shower is because your venue requires it! This means you may receive a wedding cancellation notice from the event venue if you dont have event insurance.

When securing your perfect space, the venue will often ask you to provide proof of PAL insurance or hall rental insurance. This is important because it protects the venue owners against things such as alcohol-related incidents, which can happen at weddings!

Venue owners require wedding insurance policies because they want to make sure that their space is protected from any damage that can occur throughout the event, and you want to be sure youre not on the line if Uncle Tony gets a little too rowdy after cocktail hour.

You May Like: Wedding Address Etiquette Family

Special Event Liability Insurance For Weddings And Concerts

Weddings and concerts are two of the most common special events. A private wedding in a church with a reception on the grounds will not normally require special event insurance.

However, if your wedding is a more elaborate event in a rented facility, you may have to purchase a special events insurance policy. You should take extra caution if your event involves alcohol. Liquor liability laws vary from state to state.

However, it is very possible that if you provide alcohol to a guest or participant at your wedding and that person later is responsible for an accident, you could have some legal responsibility. If you do provide alcohol, the safest thing to do is to be sure your special event insurance includes this exposure.

Concerts can vary from small, one-time events to large, elaborate affairs involving thousands of spectators. Some concerts involve fireworks, which can and have caused serious injuries and large legal claims. Large events can also involve issues having to do with crowd control.

Crowd control is a challenging issue for concert organizers to deal with. Too little crowd control can cause injuries to spectators and potential liability risks, but too much crowd control can be just as problematic and could also cause you to face a lawsuit if a patron was handled roughly by a bouncer, for example.

Independent agents can make sure that you are covered for any liability claims related to your wedding or concert.

Is Wedding Insurance Worth Getting

While most wedding venues require the renter to obtain wedding insurance, there is always a question of why.

A reasonable wedding liability insurance is an important expense for your big day. Event insurance provides protection for the insureds guests against injury, damage, and often alcohol injuries. Wedding cancellation protection insurance is an option to protect the investment of your event against cancellations, loss of gifts, and more.

It might feel like a low risk to need event insurance for one day, but once you need it, it would be too late. This is one cost that is better safe than sorry.

Recommended Reading: How To Address A Card To A Couple

Insurance For Bc Special Events Birthdays And Weddings

Are you organizing a special event soon? Perhaps youre getting married next month or planning a big 50th-anniversary party for your grandparents. Regardless of the occasion, special event insurance is useful for anyone hosting an event, whether its for business or pleasure.

From a business perspective, examples of events that require such an insurance policy include hosting or being a vendor at conferences, trade shows, festivals, sporting events and other gatherings of larger groups at a central location for business purposes. On the leisure side, celebrations such as a wedding, reception, anniversary, baby shower or other private special occasions subject people to a number of liabilities that should be mitigated by means of obtaining a solid Special Event Insurance Policy.

COVID-19 Update: Our online Special Events policies do not offer coverage should your event be cancelled as a result of a COVID-19 outbreak, or as a precaution due to COVID-19. Please contact a local insurance broker for more information.

What is included in a Special Event Insurance Policy?

General liability insurance

This element of a Special Event Insurance Policy provides protection for situations in which a host of an event or a concessionaire must defend themselves against a law-suit or against having to pay damages for bodily injury or property damage to third parties. At events where alcohol is served, the policy should also include a Host Liquor Liability component.

Social Events

What Is Wedding Liability Insurance

Liability coverage handles venue damages or injuries and illnesses to people at the wedding site. Some companies also offer liquor liability coverage, which covers you if a drunk guest gets into an accident after the wedding.

Shasha said there are many options under the liability policies.

Optional liability and liquor liability coverage can be added to a wedding insurance policy to protect your contractually assumed exposures, such as bodily injury, property damage and personal injuries to third parties at the venues where your wedding ceremony, reception and rehearsal dinner will be held. Some venues require proof of liability insurance before the event takes place, so its a good idea to get in touch with your venue ahead of time to make sure you have the right coverage, said Shasha.

Kerri McDonald from WedSure has seen many claims over the years, including hurricanes, fires, deaths in the family and closed venues.

All sorts of things happen. A lot of people get injured at weddings as well and sue the venue and the bride and groom. Those are very large claims that can go into hundreds of thousands of dollars, she said.

Remember, while everyone hopes for the perfect, problem-free wedding day, thats not always the case. The survey found that:

Don’t Miss: Wedding Planning Spreadsheet

Best Homeowners Insurance In Missouri Of 2022your Browser Indicates If You’ve Visited This Link

There are half as many homes for sale this year in Missouri compared to the previous year. If you are fortunate enough to get your offer accepted, one of the first tasks you’ll need to complete is purchasing the best homeowners insurance in Missouri before closing on a house.

Bankrate on MSN.com

How To Purchase Wedding Insurance

If you already have homeowners, renters or car insurance, check to see if you’re eligible for a discount on wedding insurance. Major carriers including Nationwide, Progressive and Allstate offer special event coverage. You can also look to companies such as Travelers, WedSafe and Wedsure, which specialize in wedding insurance.

Don’t Miss: A Practical Wedding Budget Spreadsheet

How Much Does A Wedding Cost Get Married Within Your Budget

- 9 minute read

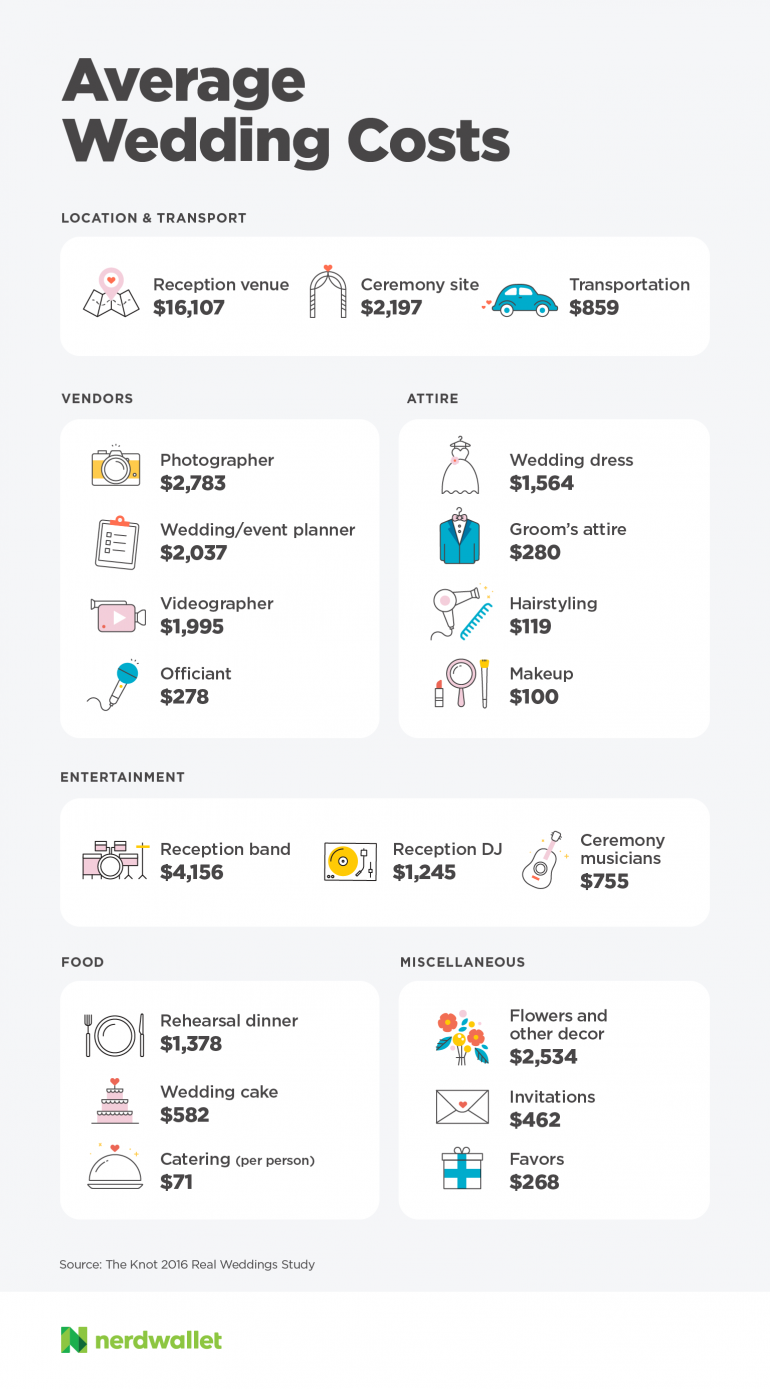

Asking newlyweds or a wedding planner for the typical things couples spend on during their weddings is one of the best ways to make a wedding budget list.

However, if you dont have anyone to ask and dont want to forget anything at the last minute, heres a list of things to buy.

When planning a wedding, there are several items to rent and wedding vendor services to budget for. They are the costs associated with weddings.

This article will show you how much a wedding will cost you in 2022.

Event Cancellation Insurance & Inclement Weather Insurance

Event Cancellation Insurance provides coverage for the loss of revenue derived from OR expenses committed to an event due to a cancellation, abandonment, interruption, curtailment, postponement or relocation caused by covered perils as defined in the policy as covered perils.

What is the difference between Event General Liability Insurance and Event Cancellation Insurance?

Special Event General Liability insurance coverage is required by venue or vendor contract and protects against 3rd party bodily injury or property damage claims. Event Cancellation Insurance is a specialty insurance coverage and is elective in nature, the premium is determined based on the revenue or expense at risk, event type, dates and location of the event and scope of coverage required. Weather and Cancellation Insurance

Also Check: Plan An Inexpensive Wedding

What Does Wedding Insurance Typically Cover

Coverage is generally broken down into two main categories, though it’s always wise to read the fine print:

- Liability insurance: This protects you if someone is injured during the event, which may include the rehearsal dinner, ceremony and reception. Property damage caused by a guest or vendor might also be covered.

- Postponement and cancellation insurance: This could come in handy if an illness, weather event or other unforeseen circumstance forces you to reschedule your wedding. Some policies will even help cover the cost of lost or damaged attire, wedding gifts, rings or photos. Chances are you won’t be covered if someone gets cold feet or simply decides to change the venue or wedding date.

In the event you need to file a claim, you’ll likely have to lay out the expenses and then wait to be reimbursed by the insurer. Just keep in mind that if you have a deductible, you’ll have to pay that amount before your insurance kicks in.

Doesnt My Home Insurance Cover Any Of The Above Examples

In some cases, yes, your homeowners policy might kick in to cover cases of bodily injury or property damage even if the wedding was held in a rented function room. Before assuming coverage though, its best to check in with your insurance agent. Host liquor liability is an especially tricky issue. Many home insurance policies contain a motor vehicle exclusion and other caveats that could leave you financially responsible for alcohol-related accidents.

In terms of lost/stolen/damaged property, keep in mind that your homeowners policy only covers personal possessions up to some limited percentage of your homes insured valuesay, 50 percent. And the insured value is not based on your homes value, but on the cost of rebuilding it. So if your home is insured for $100,000, you may only have $50,000 in coverage for personal property. Whats more, if youre traveling or in a hotel when the loss event occurs, your insurer may limit property coverage even furtherto something more like 10 percent. Now, you would only have $5,000 available to cover wedding jewelry, clothing, gifts, etc. These numbers are only offered as examples, and your situation could be very different. But it always pays to discuss your coverage with an agent.

Don’t Miss: Wedding Hastag Creator

How Much Wedding Insurance Do You Need

Not everyone needs coverage to handle the risks of a canceled wedding. A wedding venue that handles all the details of your big day may refund any lost expenses if they cause the cancellation or postponement. They may also have insurance coverage of their own. If you feel you can absorb additional costs as they arise, then you might not need additional coverage.

But if you’re set on getting wedding cancellation coverage for peace of mind, then you should look at limits that handle most of the major costs in your wedding. This should include the cost of the:

- Venue

What To Watch Out For When Purchasing Wedding Insurance

Before you make any decisions regarding wedding insurance, we recommend you do your own research and make sure to get all your questions answered. Only then will you have the peace of mind that comes from knowing your big day will be covered if the worst were to happen.

Remember that, as of June 2020, the COVID-19 pandemic has put a hold on the sale of insurance policies from many companies, especially cancellation policies. Check with each insurance provider to see if theyre offering wedding insurance at this moment.

Lastly, you must make sure a companys policy will cover expenses or commitments made before you got the policy. If youve already spent money on wedding-related services, seek out policies that will cover you for retroactive expenses.

Read Also: F Wedding Hashtags

Wedding And Special Event Insurance Is A Special Kind Of Cancellation Insurance That Can Protect You If Your Event Goes Awry

When youre thinking about planning a big eventwhether its a wedding, huge birthday bash or blowout retirement partyno one wants to think about cancellations or other disasters that could throw things off course. That said, when youre putting a lot of time and money into planning an important event, its smart to consider what you can do to protect yourself if anything goes awry. Thats where wedding insurance comes in!

Obtaining Special Event Liability Insurance Quotes

Special events come in all shapes and sizes. The one thing they share in common is the risk of injury to a person or damage to property. A properly written special event insurance policy is a must-buy item to protect your bottom line.

It can be difficult to search for event liability insurance quotes on your own. Navigating websites and calling around to agencies takes a lot of time that you might not have to spend on research. Fortunately, an independent insurance agent can help.

Independent agents work with many insurance companies, not just one, so it’s easy for them to pull together several quotes for you to compare. You’ll be able to do apples-to-apples comparisons for the insurance you need for your special event.

Contact an agent to be sure you obtain the coverage you need at a price you can afford.

TrustedChoice.com Article | Reviewed byJeffrey Green

Don’t Miss: Farm And Fleet Registry

What Doesn’t Wedding Insurance Cover

Wedding insurance doesn’t cover everything that might go wrong. While policy terms can vary by insurer, the following exclusions usually apply:

- Cost. In general, cancellations or postponements due to cost aren’t covered by wedding insurance. For instance, suppose you realize that the ceremony and reception have exceeded your budget, and you decide to scale back. In that case, your wedding insurance policy wont reimburse you for lost deposits or other expenses.

- Change of heart. If you or your partner change your mind about getting married, your policy typically won’t cover the costs resulting from the wedding’s cancellation.

- Ordinary bad weather. Wedding insurance will only reimburse you for cancellations or postponements due to extreme weather conditions, meaning conditions so severe that you, your partner, or at least half of your guests can’t reach the wedding venue. For more common weather conditionssuch as rain on the day of your beach weddingthe policy won’t reimburse you.

Before purchasing a policy, you’ll want read the terms and exclusions carefully so you understand what’s covered .