Best For Bad Credit Capital One Quicksilver Secured

Annual Fee

If you and/or your future spouse have below-average credit and cant qualify for one of the other credit cards on our list, you might consider a secured credit card. With a secured card, you pay a deposit, which serves as collateral on the card. Then you can use the card as you would any other, and it slowly but surely builds your credit card. And eventually, you can upgrade to a non-secured card.

Most secured credit cards dont offer any rewards to the cardholder. But the Capital One Quicksilver Secured stands out by offering spending on all of your purchases. Youll get 1.5% cash back on every purchase, which can really add up over the course of a year, especially when youre paying for a wedding.

Pros

- 1.5% cash back on all purchases

- Only requires fair credit

- 1.5% cash back on all purchases

- Only requires fair credit

- Few other card perks

What Are The Benefits Of The Best Credit Cards For Weddings

It feels unfair to dive into the benefits of using a credit card to pay for a wedding without reminding you that you don’t have to spend the national average — or anywhere close to that amount. You’re no less married if you spend $3,000 for a small wedding in a friend’s backyard. In fact, the entire experience may be more relaxing, and you’ll have money left to put in the bank.

But if you’ve always dreamed of a big affair with a princess dress or fancy tux, that’s fine, too. If you’re going to use credit cards to cover wedding costs or take out a wedding loan, make sure you’re doing what’s right for you.

If you do use credit cards to pay for the big day, here are a few of the benefits:

Dbs Altitude Visa Credit Card: Best For Affordable Miles & Perks

DBS Altitude Visa Credit Card is a solid choice if youd like to chase miles on the cheap and enjoy travel perks like complimentary travel accident insurance coverage of up to S$1 million and two free Priority Pass lounge visits in a 12-month membership period.

This miles credit card lets you earn unlimited 1.2 miles per S$1 spent locally, 2 miles per S$1 spent in foreign currency, and 3 miles per S$1 spent on online flight & hotel transactions . You can also earn up to 10 miles per S$1 spent on Kaligo and Expedia perfect for when youre planning the honeymoon trip of your dreams!

Apart from chalking up miles on your wedding expenses, you can snag 10,000 bonus miles simply by paying the annual fee.

Feel like splitting your wedding bills into more manageable amounts? You can do so easily via My Preferred Payment Plan and enjoy 0% interest instalments for up to six months. This should be music to your ears, agree?

Welcome Gift: Receive S$150 cashback when you key in the promo code 150CASH upon application and make a minimum spend of S$800 within 60 days of card approval. Valid till 31 January 2023. T& Cs apply.

Read Also: How Much Do Weddings Usually Cost

Should I Get A Credit Card For The Wedding

It depends. While there are many benefits to a credit card like earning a welcome bonus on rewards on purchases for your wedding, there is also the disadvantage of racking up debt, which can hurt your credit score. You should consider saving a sinking fund and fundraising the money before you turn to credit cards for wedding expenses.

Our Pick For: Easy Redemptions And A 0% Intro Apr

Card details

Rewards: 1.5 points per dollar spent.

Welcome bonus:UNLIMITED BONUS: Only Discover will automatically match all the Miles youve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. Theres no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

Annual fee:$0.

Why we like it:

You have a lot of things to worry about while juggling wedding plans. Fortunately, the Discover it® Miles is as straightforward as it gets. Unlike other travel credit cards, this card doesn’t lose any value when you redeem for non-travel options. All options, like cash back or statement credit, redeem for the same rate. Plus, you can use the lengthy 0% intro APR offer to finance any wedding-related purchases. Discovers miles-for-miles match can also be potentially lucrative, assuming you pay for most wedding expenses with the card.

Also Check: What To Get For First Wedding Anniversary

Open Credit Cards That Offer Elevated Earning Rates In Relevant Categories

Check with your venue to see if they take credit cards. If the venue does accept cards, find out how a purchase would code. If its a restaurant and its coded as dining, use a rewards card that earns bonus points on dining or restaurants, such as:

- Citi Premier® Card: Earn 3 ThankYou Points at restaurants.

- American Express® Green Card*: Earn 3 Membership Rewards points at restaurants including dining and delivery in the U.S.

If you have a destination wedding and choose to pay for a group activity for all the guests, ask whether the tour provider would code as travel. In that case, make sure to use a card that earns bonus rewards in the travel category, like the following cards:

- Chase Sapphire Reserve®: Earn 3 Ultimate Rewards points on travel worldwide.

- Capital One Venture X Rewards Credit Card: 2 miles per dollar on all eligible purchases, 5 miles per dollar on flights booked through Capital One Travel and 10 miles per dollar on hotels and rental cars when booking via Capital One Travel. Check out our guide to Capital One Rewards.

Destination wedding packages quoted by hotels also should fall under a travel spending category.

If a purchase doesnt qualify for the bonus, use the card that earns a multiplier on everyday purchases, like:

Travel tip: If youre looking to redeem the rewards for a honeymoon, consider a card that earns flexible rewards instead of an airline- or a hotel-specific credit card.

Taking Advantage Of Credit Card Rewards

The best credit cards earn rewards on purchases, and these rewards could go a long way in offsetting wedding costs. Whether youre paying for everyday expenses ahead of the wedding, or if youre using a credit card to handle purchases for the big day, each time you swipe your card you could be earning rewards that could later be used to offset wedding costs. The CardName, for example, earns 1.5% cash back on all purchases so you can take comfort in the fact that each time you make a purchase for your wedding, youre earning cash back.

There are also welcome bonuses to think about. Many credit cards offer welcome bonuses to new cardholders who meet certain spend thresholds within a set period of time from opening an account. Chances are, due to added expenses because of the wedding, meeting that threshold likely wont be difficult for many cardholders, meaning a very lucrative bonus could be easily obtained.

Sometimes these rewards are huge, such as with the CardNamediscontinued. Currently, this card is offering a one-time bonus of 75,000 miles once you spend $4,000 on purchases within three months from account opening. If you plan ahead and open this card before your wedding, reaching $4,000 in spend shouldnt be too tough. Those 75,000 miles are worth $750 in travel which could help make some couples honeymoon dreams a reality. On an ongoing basis this card earns two miles on every purchase you make, so youll continue to rack up miles each time you swipe your card.

You May Like: Where Can I Find A Wedding Planner Book

For Art Galleries Museums Or Amusement Parks

UsetheCapital One Savor Cash Rewards , which gives you 4% cash back on entertainment purchases . The card comes with a one-time $300 cash bonus once you spend $3,000 on purchases within three months from account opening. But make sure to check with your card company to ensure your venue indeed codes as entertainment. In some cases, whether or not a certain place is definitely considered a museum or gallery could be debatable.

American Express Singapore Airlines Krisflyer Ascend Credit Card: Best For Exclusive Travel Memberships

American Express Singapore Airlines KrisFlyer Ascend Credit Card is ideal for the discerning traveller who enjoys the finer things in life.

This credit card lets you enjoy complimentary Hilton Honors Silver membership tier . You will also enjoy an accelerated upgrade to the KrisFlyer Elite Gold membership tier and four complimentary annual airport lounge access passes.

Of course, you can earn unlimited, convenient KrisFlyer miles on your expenses with this credit card:

- 1.2 KrisFlyer miles for every S$1 spent on all eligible purchases

- 2 KrisFlyer miles for every S$1 equivalent in foreign currency spent overseas on eligible purchases during June and December

- 2 KrisFlyer miles per S$1 spent on singaporeair.com, SingaporeAir mobile app, silkair.com and KrisShop

- 3.2 KrisFlyer miles for every S$1 spent on Grab Singapore transactions, up to S$200 spent each calendar month

- 0.5 KrisFlyer mile per S$1 spent on Singapore Airlines Instalment Plans

If youre new to American Express and have big-ticket wedding expenses to pay for, consider signing up for this credit card to snag the sweet sign-up spend bonus, which would make a delightful surprise for your soon-to-be spouse!

SingSaver Exclusive Offer: Receive27,000 KrisFlyer Miles when you make a min. spend of S$1,000 and annual fee payment within the first month of card approval. Valid till 30 November 2022. T& Cs apply.

Don’t Miss: How To Have A Destination Wedding

Compare Credit Cards For Wedding Expenses

-

*Disclaimer

The products compared on this page are chosen from a range of offers available to us and are not representative of all the products available in the market. There is no perfect order or perfect ranking system for the products we list on our Site, so we provide you with the functionality to self-select, re-order and compare products. The initial display order is influenced by a range of factors including conversion rates, product costs and commercial arrangements, so please dont interpret the listing order as an endorsement or recommendation from us. Were happy to provide you with the tools you need to make better decisions, but wed like you to make your own decisions and compare and assess products based on your own preferences, circumstances and needs.

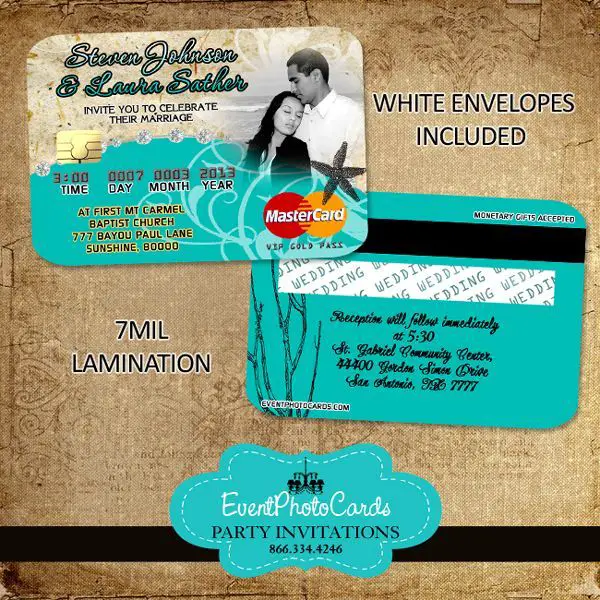

Invitations And Party Favors

Using the same shopping portal strategy is a smart choice when looking for invitations and party favors. There may be some limited options when searching through card-specific shopping portals, so it may be more practical to look at stacking rewards with discount and cashback sites.

Adding the Rakuten plugin to your browser is a good first step. This will identify if the website youre shopping on offers any cash back through Rakuten activating the offer is as simple as making one click.

Groupon is also a good place to look for specials and deals and it participates with Rakuten. When you pay for products through these sites with your rewards card, you get the discount on top of cash back, and points are added to your rewards stash. Thats smart stacking!

Read Also: What Is 60th Wedding Anniversary

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Pay Attention To The Sign

The signup bonus is one of the biggest perks most card offers. In fact, many travel hackers open cards just to take advantage of the signup bonuses. They can often equal hundreds or even thousands of dollars in perks. Cards regularly change their signup bonuses, to be sure to read up on the best current signup bonuses to take advantage of those offers.

Don’t Miss: What To Say In A Wedding Card

The Best Travel Rewards Cards For Couples

Scroll down to read the breakdown of the sign-up bonuses, minimum spending requirements, additional perks, and why we love each of these cards for earning points to travel hack!

- Sign-up Bonus: Spend $2,000 in the first 3 months and receive 50,000 Marriott points

- Annual Fee: None

- Perks: 3 points per dollar spent at Marriott locations, 2 points per dollar spent on other travel purchases, 1 point per dollar spent on all other purchases, stay 4 nights at a Marriot and get your 5th night free

Our Take: The is Marriotts no fee alternative to the Boundless card. You wont receive an annual free night from this card, but the no fee and 50,000 point sign-up bonus are a great way to get started with travel hacking.

Pros Of Paying With A Credit Card

Advantages of paying with a credit card include:

- Protection: If you need to dispute a charge, using a credit card can give you the protection that you don’t have with cash. For example, if a vendor delivers a good or service that wasn’t what was initially agreed on, you can dispute it within 60 days after receiving a bill with the charge in question.

- More time to pay: If you use a card with a zero percent or low APR rate, you’ll be able to pay back the amount borrowed over time instead of having to pay for everything all at once

- New cardmember bonuses: Many cards have new cardmember bonuses to entice new customers. They require spending a certain amount within the first few months of owning the card which, if you’re using the card to pay for a wedding, may be easy to accomplish depending on the card and if the recipient accepts credit card payments. Certain purchases may not count towards bonus points and some aspects of the wedding may not allow credit card payments.

Recommended Reading: What To Include On Wedding Details Card

If You Can Only Get One Credit Card

You may not have the credit score, time or energy to get several different cards we get it, wedding planning can be draining . But dont worry, if you can only get one card, the Discover It Cashback is a solid choice especially if you need to finance certain aspects of the wedding as it offers 0% APR for 14 months.

While you only get 1% cash back on most purchases , the card will match all of the cash back youve earned at the end of the year, meaning you can recoup some of those hefty wedding costs. Tip: Make sure to apply for the card at just the right time in order to charge all your wedding expenses during the first year of card membership for the maximum amount of cash back possible.

One final note: You can strategically use pricey expenditures such as those associated with a wedding to help you hit those hefty spending minimums that earn sign-up bonus points, like the $5,000 on the Amex Platinum in the first three months of card membership, which gets you 60,000 Amex Membership Rewards points or the 50,000 Chase Ultimate Rewards points you earn after spending $4,000 on the Chase Sapphire Reserve card in the first three months of card membership. These points can later be transferred and used for honeymoon travel. The perks increase for couples as BOTH of you can get new credit cards after all, the couple that spends together, stays together .

Top 10 Credit Cards For Your Wedding

Calculating wedding expenses can be a pain in the neck. Credit cards are a fantastic way to make purchasing all your wedding needs more convenient and easier to keep track of. Not only so, credit cards often come with attractive rewards and benefits that you can enjoy! The best credit cards are the ones that will give you a great amount of Cashback on your spending, as well as rewards that you can redeem from the accumulation of points. Rewards can range from those that will help you offset your wedding costs, or travel privileges that will be useful when you go for your honeymoon!

Image courtesy of Digio Bridal

With that being said, credit cards should never be used in place of real money, and you should only apply for one if you are sure of being able to pay off what you charge to your credit card. Not being able to do so would incur unwanted interest, making it a source of a bad headache as you plan for your big day. Keeping that in mind, here are 10 great credit card deals for your wedding!

Image Courtesy of Standard Chartered

With Standard Chartered MANHATTAN World MasterCard®, youll be promised with unbelievably great benefits that you dont want to miss. Earn up to 3% Cashback when you spend S$3,000 and above every month, accumulating up to S$800 Cashback within a year !

Also Check: How To Create Wedding Filter On Instagram

Best Credit Cards For Wedding Expenses

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Youre getting married congratulations! Now its time to figure out how to pay for it.

The cost of a wedding may be intimidating, but you can lessen the impact on your wallet by maximizing credit card rewards and perks. The average cost of a wedding was $33,900 in 2019, according to an annual survey by The Knot. On that amount, a credit card’s incentives could earn you several hundred dollars toward your honeymoon or a purchase. Or you could finance a much-needed wedding expense even an engagement ring with a credit card and get interest-free breathing room while catching up on payments.

The right credit card for your wedding should be as compatible with your expenses as your partner is with you. Heres how to find the one.